For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. He is the sole author of all the materials on AccountingCoach.com. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

What is your current financial priority?

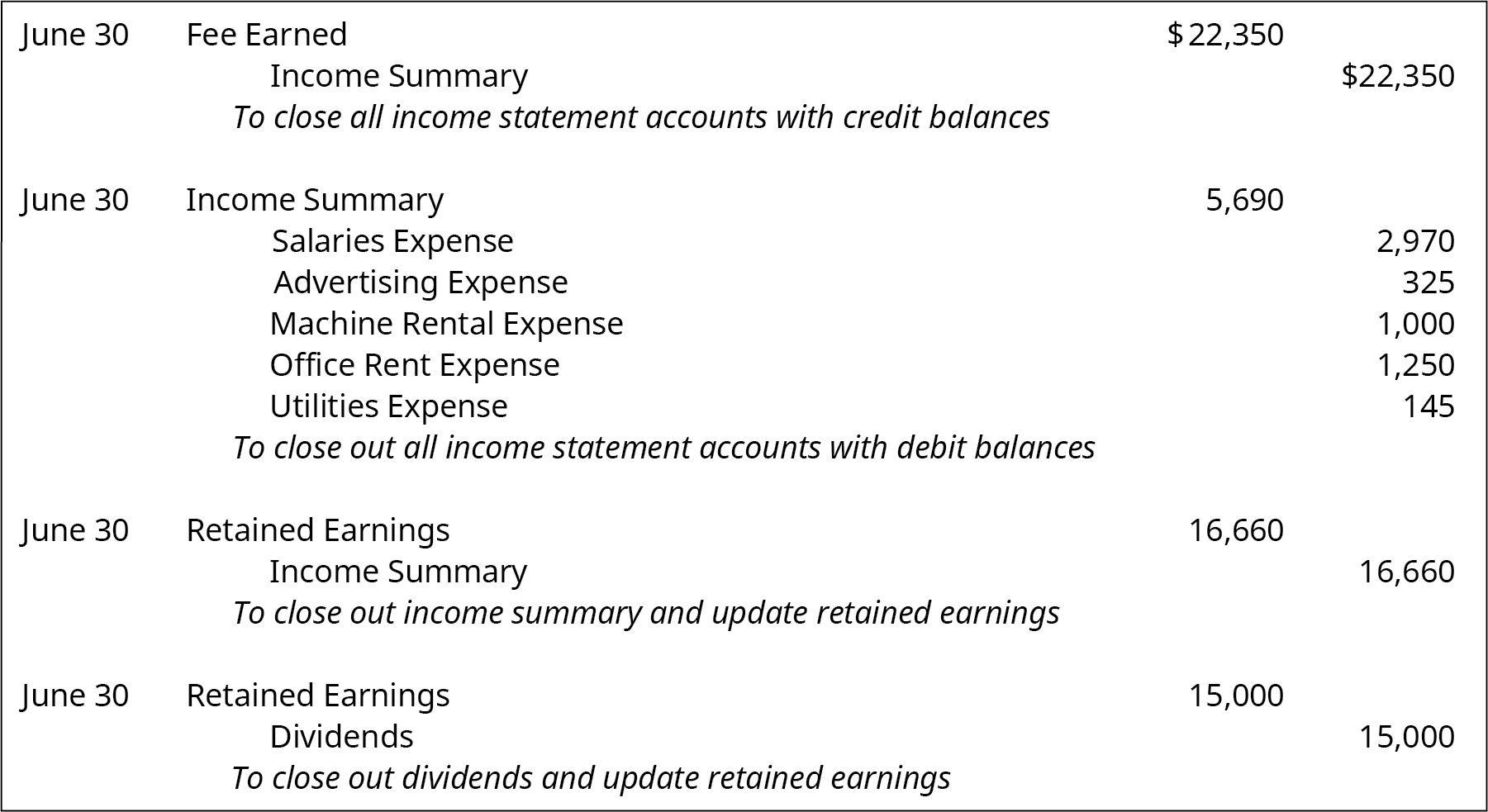

The third entry requires Income Summary to close to the RetainedEarnings account. To get a zero balance in the Income Summaryaccount, there are guidelines to consider. With the use of modern accounting software, this process often takes place automatically. An accounting how to design products with operations management in mind year-end which is not the calendar year end is sometimes referred to as a fiscal year end. The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider.

- These accounts must be closed at the end of the accounting year.

- Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt.

- Such periods are referred to as interim periods and the accounts produced as interim financial statements.

What do closing entries include?

Expense accounts have a debit balance, so you’ll have to credit their respective balances and debit income summary in order to close them. This time period, called the accounting period, usually reflects one fiscal year. However, your business is also free to handle closing entries monthly, quarterly, or every six months. An accounting period is any duration of time that’s covered by financial statements. It can be a calendar year for one business while another business might use a fiscal quarter.

Step 4: Transfer Balance

Permanent accounts, such as asset, liability, and equity accounts, remain unaffected by closing entries. These permanent accounts form the foundation of your business’s balance sheet. However, you might wonder, where are the revenue, expense, and dividend accounts?

What are your total expenses forrent, electricity, cable and internet, gas, and food for thecurrent year? You have also not incurred any expenses yet for rent,electricity, cable, internet, gas or food. This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period.

Post navigation

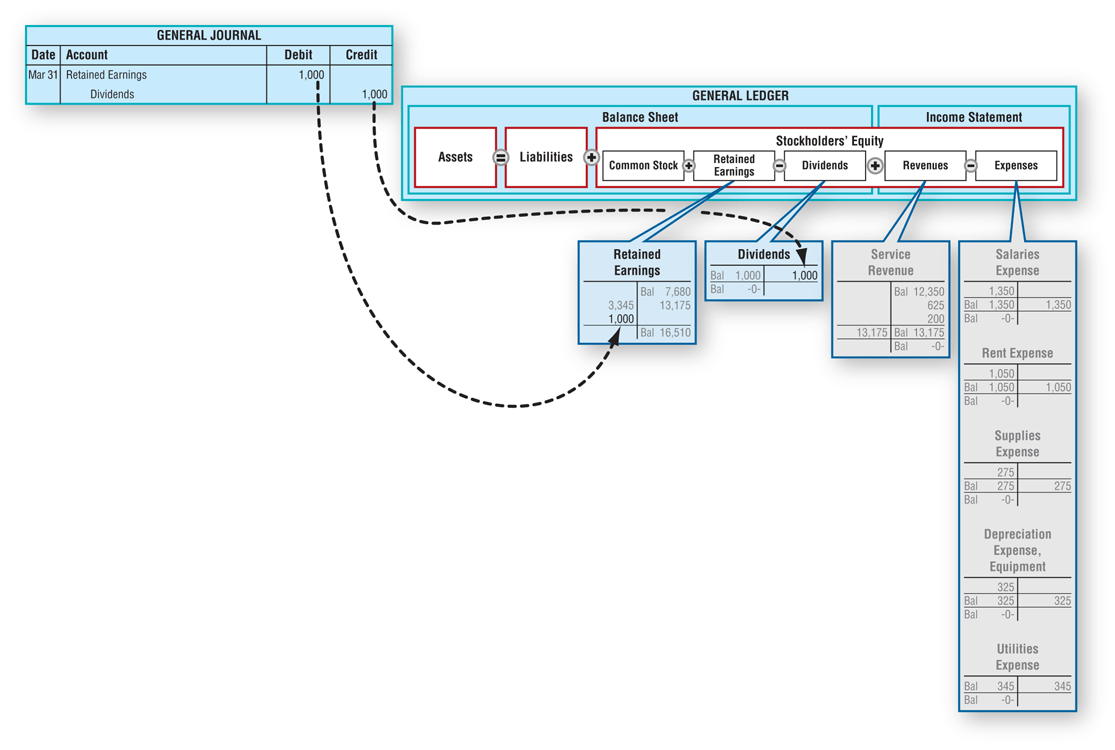

All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero. The balances from these temporary accounts have been transferred to the permanent account, retained earnings. This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account.

In this example, it is assumed that there is just one expense account. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. The trial balance is like a snapshot of your business’s financial health at a specific moment. It lists the current balances in all your general ledger accounts.

Take note that closing entries are prepared only for temporary accounts. Remember that expense accounts have a normal debit balance so a credit will zero out their balance and then you can debit the income summary to move it. Remember that revenue accounts normally have a credit balance so here we are debiting them to zero them out.